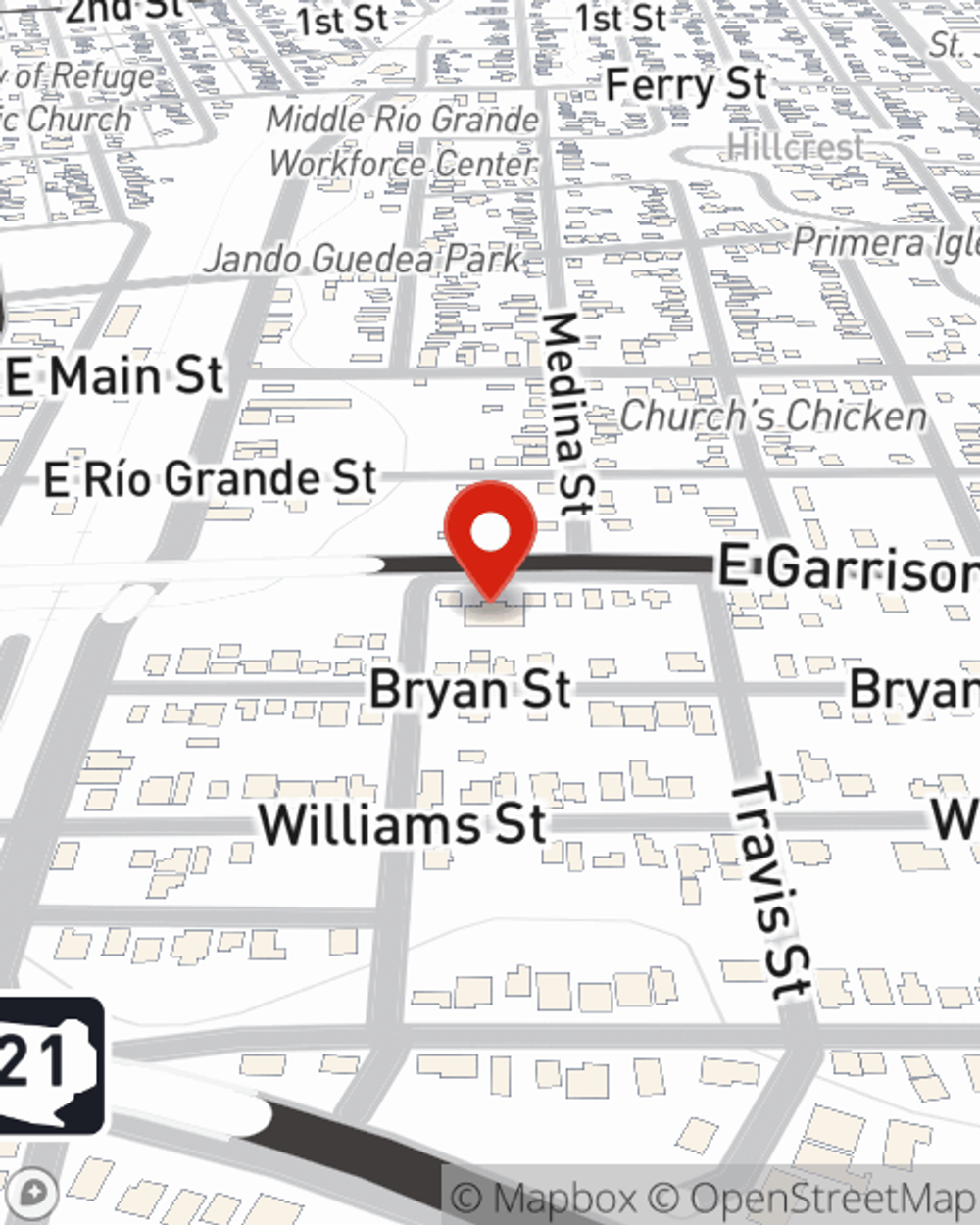

Life Insurance in and around Eagle Pass

Life goes on. State Farm can help cover it

What are you waiting for?

Would you like to create a personalized life quote?

- Eagle Pass

- Maverick county

- La Pryor

- Quemado

- Del Rio

- Uvalde

- Piedras Negras

- El Paso

- Brackettville

- Carrizo Springs

State Farm Offers Life Insurance Options, Too

Do you know what funerals cost these days? Most people aren't aware that the average cost of a funeral nowadays is $8,500. That’s a heavy burden to carry when they are facing grief and pain. If the people you love cannot pay for your burial or cremation, they may fall on hard times in the wake of your passing. With a life insurance policy from State Farm, your family can thrive, even without your income. Whether it keeps paying for your home, pays for college or pays off debts, the life insurance you choose can be there when it’s needed most by your loved ones.

Life goes on. State Farm can help cover it

What are you waiting for?

Love Well With Life Insurance

You’ll get that and more with State Farm life insurance. State Farm has excellent protection plans to keep your family members safe with a policy that’s adjusted to accommodate your specific needs. Thankfully you won’t have to figure that out by yourself. With solid values and excellent customer service, State Farm Agent Stephany Valdez walks you through every step to build a policy that secures your loved ones and everything you’ve planned for them.

State Farm offers a great option for individuals who thought they couldn't qualify for life insurance: Guaranteed Issue Final Expense. This coverage can be helpful by covering final expenses like medical bills or funeral costs, ensuring that your loved ones won't have to bear the burden. For a free quote on Guaranteed Issue Final Expense, contact Stephany Valdez, your local State Farm agent and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Stephany at (830) 773-1802 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Stephany Valdez

State Farm® Insurance AgentSimple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.